“Health-conscious” does not mean the same thing in every market. Some shoppers seek ingredient simplicity and minimal processing. Others prioritize responsible sourcing, sugar reduction, or clean-label formats that fit their routines. The practical requirement for brands is consistent: keep messaging anchored to verifiable facts and avoid language that implies treatment, prevention, or cure.

1) What health-conscious buyers typically respond to

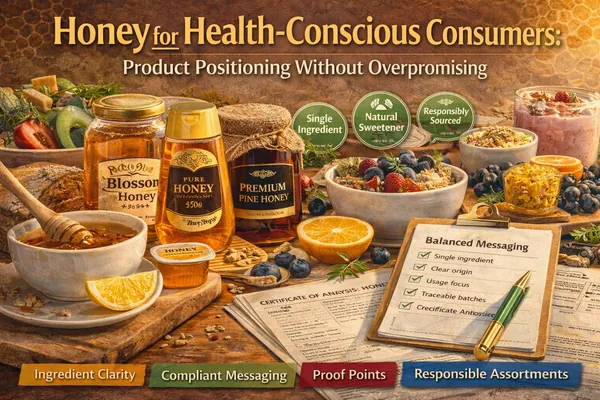

- Ingredient clarity: “Honey” as the ingredient, with transparent origin and batch traceability.

- Process transparency: straightforward statements about handling (e.g., filtered/strained) where applicable.

- Serving guidance: portion suggestions and usage contexts (tea, breakfast, baking) rather than promises.

- Consistency: repeatable taste and color across shipments; stable pack formats and labeling.

2) Safer messaging frameworks (label-friendly direction)

The best positioning is not “bigger claims.” It is better framing. Instead of implying outcomes, focus on what the consumer can experience and verify.

| Avoid | Use instead | Why it works |

|---|---|---|

| “Boosts immunity” | “A natural sweetener with a distinct floral profile” | Stays sensory and factual; avoids medical implications. |

| “Detox / cleanses” | “Simple ingredient, easy to use in daily routines” | Talks about usage, not physiological outcomes. |

| “Treats sore throat” | “Smooth sweetness for tea, yogurt, and breakfast” | Consumption context is generally safer than treatment language. |

| “Cures / prevents disease” | “Quality-focused sourcing and batch traceability” | Leans on credibility and compliance signals. |

3) Proof points that increase credibility

Health-conscious consumers—and the retailers who serve them—often equate trust with documentation and consistency. Positioning becomes easier when you can back “quality-focused sourcing” with practical, buyer-relevant materials.

- Spec sheet: clear parameters and a stable product description for buyers.

- Batch identification: lot coding and traceability alignment.

- Label readiness: ingredients, net weight, origin statement, and shelf-life/storage guidance.

- Packaging details: jar material, closure type, carton configuration, pallet pattern.

4) Assortment strategy for “better-for-you” shelves

In many markets, the most effective set is a focused portfolio that reduces shopper confusion and keeps replenishment simple. A common pattern is a high-turn everyday honey plus one or two trade-up options.

| SKU | Role | Positioning angle | Packaging fit |

|---|---|---|---|

| Everyday honey | Volume driver | Daily use, simple ingredient | Durable retail packs; easy re-order |

| Differentiation honey (pine / monofloral) | Trade-up | Distinct taste, origin narrative | Premium labels; gift-ready where relevant |

| Controlled-serve format (squeeze / portion) | Convenience | Portion control, mess reduction | Foodservice + select retail segments |

5) Packaging and labeling cues that signal responsibility

- Clean front label: avoid crowded promise language; emphasize origin, taste, and usage.

- Storage guidance: simple instructions reduce misuse and complaints.

- Portion clarity: serving suggestions help “moderation” messaging without moralizing.

- Consistency: stable pack sizes and carton counts improve retailer confidence.